Drawing Social Security Age 62 Continue to Work Earn Credits

Executive Summary

The conventional view of delaying Social Security is that doing so is an opportunity to earn delayed retirement credits, an 8%/year increase in benefits that can be highly appealing in today's low-yield environment.

However, the reality is that delaying Social Security benefits doesn't just increase benefits by earning delayed retirement credits. Additional years of working while collecting Social Security benefits can also increase the worker's Average Indexed Monthly Earnings used to calculate those Social Security benefits in the first place, just as ending work early can reduce AIME below what is projected as benefits on the Social Security statement.

And depending on how much additional income will be earned – and how low his/her historical earnings really are – the reality is that continuing to work while getting Social Security benefits can produce a material increase in future payments for some workers, simply because of how benefits are recalculated. In other words, for those past full retirement age (and no longer subject to the Earnings Test), it's possible to be receiving Social Security benefits while working andhave those years added to the Social Security work history to generate higher future benefits as well!

In the end, working while on Social Security won't always produce a significant increase in Social Security benefits. For those whose prior working years produced more income – at least on an inflation-adjusted basis – it's possible that continuing to work will generate no additional benefits at all. Nonetheless, for those who haven't fully capped out Social Security benefits based on 35 years of maximal earnings already, it is possible to be working and getting Social Security benefits at the same time, and have that work increase the benefits (at least after reaching full retirement age). And the potential for a benefits increase can be material in some cases, and thus should definitely be considered in the timing and impact of when to stop working!

Similar to a pension, Social Security provides a stream of retirement income that continues as long as the recipient is alive (and adjusts for inflation along the way). And also like a pension, Social Security calculates its benefits by applying an "income replacement" formula, based on the earnings of the individual during his/her working years.

The difference, however, is that while a pension might simply be calculated based on an individual's last-3 or last-5 years of earnings, Social Security is actually paid out based on an average of 35 years of lifetime earnings. And it doesn't have to be a consecutive 35 years or the last 35 years; Social Security uses whatever the highest 35 years were over the worker's entire career.

Calculating Average Indexed Monthly Earnings (AIME)

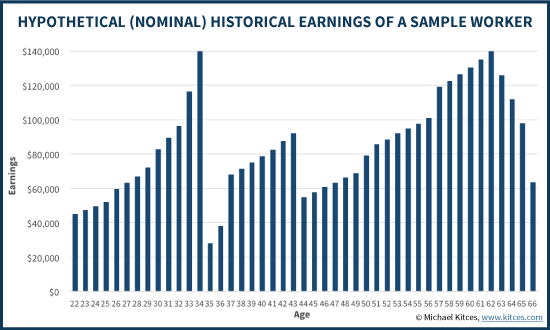

The caveat to calculating an average of a worker's highest 35 years of historical earnings is that in the distant past, earnings were typically lower – not just because the worker might have been earlier in his/her career, but simply because inflation lifts average wages over time (which means older more distant wages were lower in part simply because the inflation hadn't happened yet!). For instance, the chart below is an example of one worker's hypothetical historical earnings, with a high point in the early years (before a career change) but in general a slow upward trend to earnings over time.

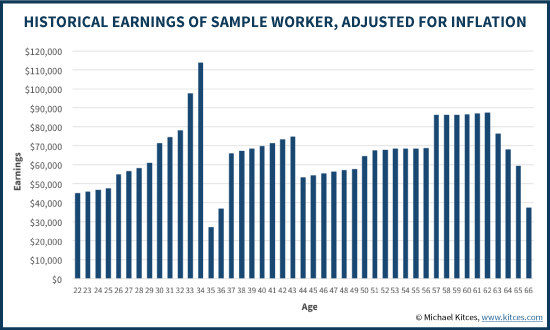

Accordingly, when Social Security determines the 35-year average of earnings, it first inflation-adjusts those earnings into current dollars using the National Average Wage Index. Technically, this is done by inflation-indexing all historical earnings into a base year that was 2 years before the individual turned 62 and first became eligible for benefits. Thus, a 62-year-old in 2016 will have historical earnings inflation-adjusted to the 2014 wage index; in general, Social Security benefits are indexed to wage levels 2 years before becoming eligible at age 62, which means indexed to the individual's age 60. This ensures that benefits based on historical average wage calculation isn't indirectly reduced simply due to the fact that wage inflation hadn't yet occurred in the past.

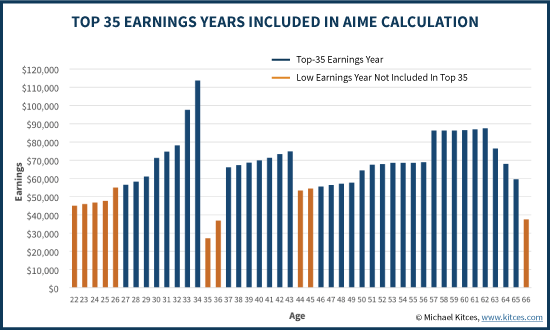

Once inflation-adjusted earnings have been calculated throughout all the working years, it's possible to determine which were the highest 35 years of earnings that will be included in the Social Security benefits calculation (while the remaining "lower income" years are thrown out, as shown below).

In turn, once the highest 35 (inflation-adjusted) years of earnings have been determined, an average of those years can be taken. In our example above, this would equate to about $72,000/year.

Notably, since Social Security benefits are ultimately paid on a monthly basis, they are also calculated on a monthly basis. Accordingly, the individual's Average Indexed Monthly Earnings (or AIME for short) would be $72,000/year divided by 12 months/year = $6,000/month. Alternatively, this simply means the AIME is calculated by adding up the top 35 years of Social Security work history, and dividing by 35 years x 12 months/year = 420 months to determine the AIME, which is then used to calculate the actual Social Security benefit.

While the AIME determines the amount of average lifetime earnings that will be used to calculate a Social Security benefit, the actual benefit calculation still requires applying the income replacement factors.

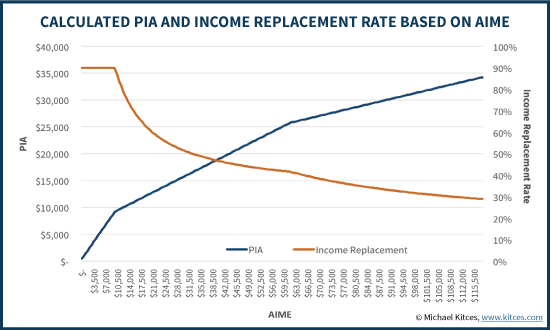

With pensions, it was/is typical to use a single replacement percentage tied to years of work. For instance, a worker's pension income might be 2% of final wages for each year worked, which means someone with 35 years of working history will receive a 35 years x 2%/year = 70% replacement rate. With Social Security, however, there are 3 replacement rate tiers, and they're based not on the number of years worked, but on the worker's average earnings in the first place (as calculated by AIME).

Specifically, Social Security is calculated by replacing 90% of the first $856/month (in 2016) of AIME, plus 32% of the next $4,301/month of AIME (up to $5,157 of total AIME), plus 15% of any remaining income above $5,157/month of AIME. The last 15% tier applies up to the maximum amount of earnings that can ever be considered for Social Security, which in 2016 is $9,875/month (equal to the maximum Social Security wage base of $118,500/year – thus the only earnings included in the Social Security benefits formula are the earnings subject to Social Security taxation).

The benefit calculated under this income replacement formula is called the Primary Insurance Amount (or "PIA" for short), and represents the benefit the retiree would get at full retirement age. (Starting benefits early entails a reduction, and postponing them later can still earn an appealing delayed retirement credit.) Because the Social Security income replacement formula has multiple tiers, the net result is that as income (AIME) increases, the actual Social Security benefit PIA) increases more slowly... which in turn means Social Security effectively replaces a higher percentage of income for lower-income workers, and less for higher-income workers.

Example 1. If the lifetime inflation-adjusted average earnings of $72,000/year (or $6,000/month) charts shown earlier belonged to Daphne, her benefits would be 90% x $856/month plus 32% x $4,301/month, plus 15% of the remaining $843/month, for a Primary Insurance Amount of $2,210.47/month. If Daphne begins her benefits early (as early as 62) the $2,210.47/month will be reduced, and if she delays (as late as age 70) they will be increased. This Social Security benefit replaces 36.8% of Daphne's career earnings.

Example 2. On the other hand, assume Jeremy has a lifetime inflation-adjusted income (AIME) of only $24,000/year (or $2,000/month). Accordingly, Jeremy's benefits would be 90% x $856/month plus 32% x the remaining $1,144/month, for a PIA of $1,136.48. Again if Jeremy starts early the benefits will be reduced, and if he delays they will increase. Nonetheless, Jeremy's overall benefits are 56.8% of his lifetime income – a higher replacement rate at lower income levels, thanks to the graduated tiers of the Social Security income replacement formula.

For someone who earns the maximum income eligible for Social Security throughout their working career, the maximum Social Security benefit is $2,639/month in 2016. (Notably, this is slightly smaller than just applying the Social Security income replacement formulas to a maximum income of $9,875/month, due to the fact that the inflation indexing effectively only applies up to age 60, and from that point forward benefits are simply calculated based on actual earnings increases for inflation.)

So given these dynamics for calculating Social Security benefits, what are the consequences of someone continuing to work and adding in more years of income – either leading up to becoming eligible for retirement benefits, or even in their 60s and beyond as they are already eligible for benefits?

As noted earlier, for Social Security the income replacement tiers are always the same percentages with the same thresholds, regardless of how long someone worked (and unlike a pension where the replacement rate is often higher as the number of years-worked accrues). Thus, regardless of the number of years worked, the formula to convert the AIME into PIA will always be the same, even with additional working years.

However, what does change with additional working years is the calculation of the AIME itself. Since the AIME is calculated based on the highest 35 years of earnings – and they can even be non-consecutive years – then additional working years that add to the highest-35, and knock off a prior "lower income" year, can increase the AIME calculation, and therefore the amount of Social Security benefits.

Example 3. Continuing the earlier example #1 with Daphne, assume that Daphne gets a high-income consulting job late in her career, which pays her enough to reach the Social Security wage base limit. Earning the maximum $118,500 wage base for this year will replace her prior lowest inflation-adjusted income year of $55,500. The additional $63,000 of higher earnings will in turn increase the 420-month AIME by $63,000 / 420 = $150, and given the 15% replacement tier will in turn increase Daphne's PIA by $22.50. The end result: by adding in a year of $118,500 income to replace the prior $0 year, Daphne's benefit increases by $22.50/month, a mere 1.02% increase in Social Security retirement benefits!

As this example highlights, the key driver of whether it's worthwhile to keep working for higher Social Security benefits depends on how much the individual expects to earn in the coming year, and what his/her lowest inflation-adjusted income year was in the past. As it is the difference between the two that drives the outcome. In addition, what PIA income replacement tier the worker is in also has a dramatic impact on the value of additional years of earnings, as revealed in the example below.

Example 4. Continuing the earlier example #2, Jeremy wants to understand the impact of adding in a year of high earnings to his $24,000/year historical earnings. Following the approach above, Jeremy first determines which Social Security bend point would apply (with $24,000/year of historical earnings, or an AIME of $2,000/month, he's eligible for the 32% rate). Next, Jeremy finds which of his high-35-years of inflation-adjusted earnings is the lowest (we'll assume it's $24,000 and that he had flat inflation-adjusted income throughout life). If Jeremy can earn the Social Security wage base maximum of $118,500, it will be an increase in earnings of $94,500 over his lowest income year, which means his benefits will be increased by $94,500 / 420 x 32% = $72/month! Given that his PIA was originally $1,136.48/month, this is a whopping 6.3% increase in lifetime benefits by adding in one high-income year!

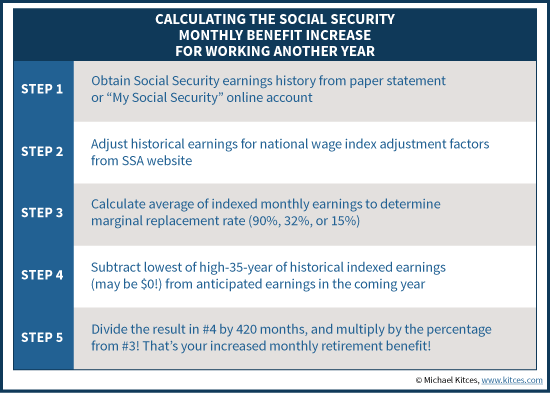

Of course, the caveat is that determining whether an upcoming year's worth of earnings may be higher than historical inflation-adjusted earnings requires first determining what those historical earnings were on an inflation-adjusted basis. This can be estimated by first obtaining the individual's Social Security work history, which can be found by logging into the individual's "My Social Security" online account, or drawn directly from his/her Social Security statement. Once those historical earnings are found, they can be adjusted using the National Wage Index adjustment factors (which can be requested directly from the Social Security Administration website), to determine what the inflation-adjusted historical earnings amounts really were.

Obtaining the list of year-by-year historical earnings from the Social Security work history record is ultimately necessary for two reasons. First, it's necessary to determine which of the three "bend points" – the Social Security income replacement rates – will apply, as there's a big difference in benefit between the 90%, 32%, and 15% levels! Second, having historical inflation-adjusted earnings makes it possible to compare the upcoming year's earnings to the lowest historical inflation-adjusted year, to determine the income difference and prospective increase in AIME.

In fact, once the rest has been determined, the Social Security benefit increase for working another year is simply the difference in earnings between the new year and the lowest historical year, divided by 420 (the number of months in the 35-year average for AIME), and multiplied by the 90%, 32%, or 15% replacement rate!

In the end, whether or how beneficial it is to continue to work while on Social Security in order to generate higher Social Security benefits in the future depends heavily on two factors: what income replacement tier (90%, 32%, or 15%) the Social Security recipient will be in (based on average historical earnings from the Social Security work history); and what the existing earnings history already was (because the increase in benefits is based only on the difference between the new year of earnings and the prior lowest year that is removed from the equation). Similar to the consequences of retiring early (and not continuing to work up to full retirement age in the first place), the consequences vary depending on where the individual is in the AIME calculation.

How Will Work AffectYourBenefits?

The lower the historical inflation-adjusted income, the more significant the value of continuing to work, both because the income replacement tier may be more favorable, and because there will typically be lower income years to replace. In the logical extreme, where a worker doesn't even have 35 years of historical earnings, additional working years will replace a $0 year in the AIME equation with the new year's worth of earnings, giving the full benefit of the earnings at the current income replacement tier to be added into Social Security benefits! (And of course, if the worker didn't even have the requisite 40 quarters of eligible work to get a Social Security benefit, continued work can be the difference between getting some benefit or nothing at all!)

On the other hand, if the historical earnings are already high enough that adding another income year doesn't replace any of the prior years, the impact of having another working year could be precisely $0 on future Social Security benefits! Or if historical AIME was already high, adding in a higher income year (e.g., $100,000/year of earnings) could have a very modest effect if the prior lowest year was already $80,000 (which means the income increase is only $20,000, and once dividing by 420 and multiplying by the lowest 15% replacement tier, is a mere $7/month benefits increase!).

It's also worth noting that since continuing to work increases the worker's overall PIA, it increases not only his/her own benefit, but any other benefits paid based on that earnings record – which means continued work can increase the retirement benefit, and a spousal benefit, dependent benefit, or a future survivor benefit as well.

The only important caveat to the strategy of receiving Social Security benefits and working at the same time is the Social Security Earnings Test - where ongoing earned income (i.e., wages from a job or self-employment income) can partially or fully reduce retirement benefitsif they are taken early.So you cannot retire at 62 and still work, or earned income above the Earnings Test threshold will reduce the retirement benefits. The strategy of working while getting Social Security benefits is only viableafterreaching full retirement age (currently age 66). On the other hand, beyond that point, it really is possible for each subsequent year of work in someone's late 60s or even 70s and beyond, to be receiving Social Security benefits while working and have those benefits recalculated for the future based on another year of work (if the additional work year really does increase AIME)!

The bottom line, though, is simply to recognize that it's possible to be receiving Social Security benefits and work, and in fact continuing to work can continue to increase future Social Security benefits. The actual impact, though, is heavily dependent on just how high the historical inflation-adjusted earnings have been – and whether there's a low year amongst the top-35 prior years that could be "upgraded" for a higher benefit. In addition, the relative benefit of continuing to work is heavily dependent on which income replacement rate the worker is eligible for – as at the upper end of the income scale the additional benefits are modest, but at the lower end, the formulas can provide a tremendous boost for continuing to work just a few more years!

So what do you think? Have you ever counseled a prospective retiree to keep working after 66 not just to delay Social Security benefits, but to increase their earnings in order to be eligible for a higher calculated benefit? Would you consider the strategy in the future? Please share your thoughts in the comments below!

Source: https://www.kitces.com/blog/social-security-and-working-how-adding-to-social-security-work-history-can-increase-retirement-benefit/

0 Response to "Drawing Social Security Age 62 Continue to Work Earn Credits"

Post a Comment